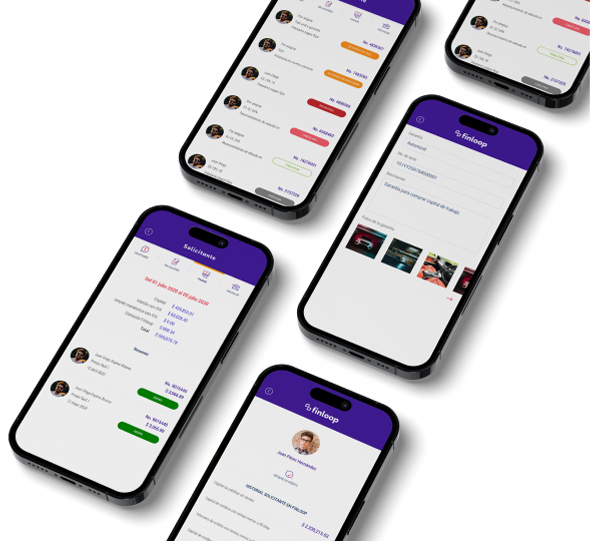

Las empresas de tecnología financiera crecieron 16 por ciento anual en 2021, con lo que ya integran un ecosistema de 512 startups fundadas y operando en el País. Los segmentos que más crecieron fueron Banca Digital y Préstamos, con empresas como Crecy, Hurra Credit, Lanissimo, Efektiva, Prestanómico, PitchBull y Finloop, entre otras...

We are a financial technology that manages the financial operations of our Finloop partners (affiliated companies that grant formal credits)